Actual Working Papers

From Stocks to Flows

Evidence for the Climate-Migration-Nexus

Berlemann, M., Haustein, E., Steinhardt, M. (2021), IZA Discussion Paper No. 14450, IZA Institute of Labor Economics.

Slow onset climate change has the potential to cause significant migration flows. Scientists have recently made considerable efforts to quantify these flows based on empirical methods. However, the literature on international migration has failed to come to a clear conclusion as many studies found no significant effects of climate, while others did. In this paper, we aim to uncover a factor which likely contributes to the mixed picture in the literature: how migration flow data is obtained from migrant stock data. Using the influential study of Cattaneo and Peri (2016) as a workhorse, we demonstrate that the derived empirical results depend heavily on the applied method to derive migration flows. Therefore, our study reveals the necessity for future research on international migration to test the sensitivity of estimated effects to changes in the construction of migration flows.

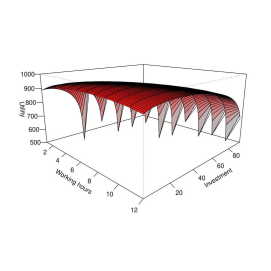

Intertemporal Optimization Under Disaster Risk

Some Experimental Evidence

Berlemann, M., Michailova, J. (2020), Working Paper, Helmut-Schmidt-University Hamburg.

In this paper we study whether individuals are capable of solving intertemporal optimization problems under disaster risk and how they react to changes in different sorts and levels of risk. In order to do so we run various variants of an internet-experiment with sampled participants, designed as a simplified two-period version of the Lucas-Uzawa model of economic growth. We find that individuals generally fail to play the optimal intertemporal strategy both with and without risk. However, individuals tend to react predictably to changes in risk levels only when risk becomes extreme.

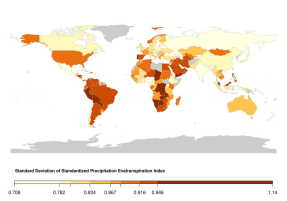

Precipitation and Economic Growth

Berlemann, M., Wenzel, D. (2018), CESifo Working Paper No. 7258, CESifo Munich.

In this paper we study the growth effects of precipitation in the short-, medium and the long-run, thereby distinguishing between country groups on differing levels of development. We use several different precipitation indicators and study linear as well as non-linear precipitation effects and employ three different rainfall datasets. We find significantly negative and long-lasting growth effects of dry periods especially for comparatively poor countries whereas overly wet periods mainly remain without effect.

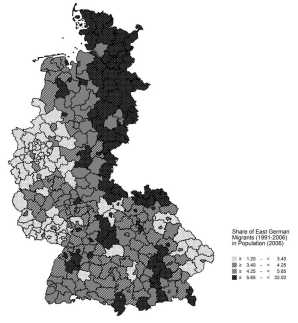

Institutional Reform and Depositors’ Portfolio Choice

Evidence from Bank Account Data

Berlemann, M., Luik, M.-A. (2016), Working Paper No. 173, Helmut-Schmidt-University Hamburg.

In this paper we employ the natural experiment of German Division and Reunification in order to study the effect of institutional reform on risky portfolio choice. We present empirical evidence indicating that 16 years after German Reunification portfolios of East and West German bank customers differed systematically. While these differences are especially pronounced for bank customers with experiences in the former communist system, even the younger generation of East Germans still differs remarkably from their West German counterparts in terms of risky asset choice. Thus, informal institutions tend to have long-lasting effects on portfolio behavior.

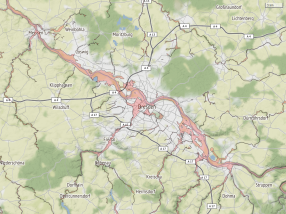

Do Natural Disasters Stimulate Individual Saving? Evidence from a Natural Experiment in a Highly Developed Country

Berlemann, M., Steinhardt, M. & Tutt, J. (2015), IZA Discussion Paper No. 9026, IZA Bonn.

While various empirical studies have found negative growth-effects of natural disasters, little is yet known about the microeconomic channels through which disasters might affect short- and especially long-term growth. This paper contributes to filling this gap in the literature by studying how natural disasters affect individual saving decisions. This study makes use of a natural experiment created by the European Flood of August 2002. Using micro data from the German Socio-Economic Panel that we combine with geographic flood data, we compare the savings behavior of affected and non-affected individuals by using a difference-in-differences approach. Our empirical results indicate that natural disasters depress individual saving decisions, which might be the consequence of a Samaritan`s Dilemma.

Institutions, Experiences and Inflation Aversion. Empirical Evidence from a Natural Experiment

Berlemann, M., Enkelmann, S. (2014), Department of Economics Working Paper No. 143, Helmut-Schmidt-University Hamburg.

Based on data from the Eurobarometer Survey we study the individual determinants of inflation aversion in Germany. Although West Germans are well-known as highly inflation averse, we find even larger levels of inflation aversion among East Germans. Two possible explanations of this finding are discussed: (i) differences in inflation experiences and (ii) institutional discrepancies throughout the period of German division. We argue that most likely the observed inflation aversion patterns are the consequence of only slowly changing informal institutions in East Germany.